Our conversations last year with HR and benefits teams made clear: Going into 2023, they want more from their health plan partners.

Facing ever-rising healthcare costs, often without a corresponding boost in outcomes, self-funded employers are looking to play a more active role in evaluating the ROI of medical management programs delivered through their health plans. Increasingly, they’re demanding that their health partners deliver on the promises of value and whole-person health.

As a health plan, here are five trends you should be considering as you adapt to new customer realities in 2023:

1. Your customers and prospects want to see a data-backed plan for reducing the total cost of care

Winning and retaining employer ASO business used to be simpler for you: It required a wide provider network and competitive discounts.

Today, employers are seeking health plan partners that offer data-backed strategies for managing whole-person health.

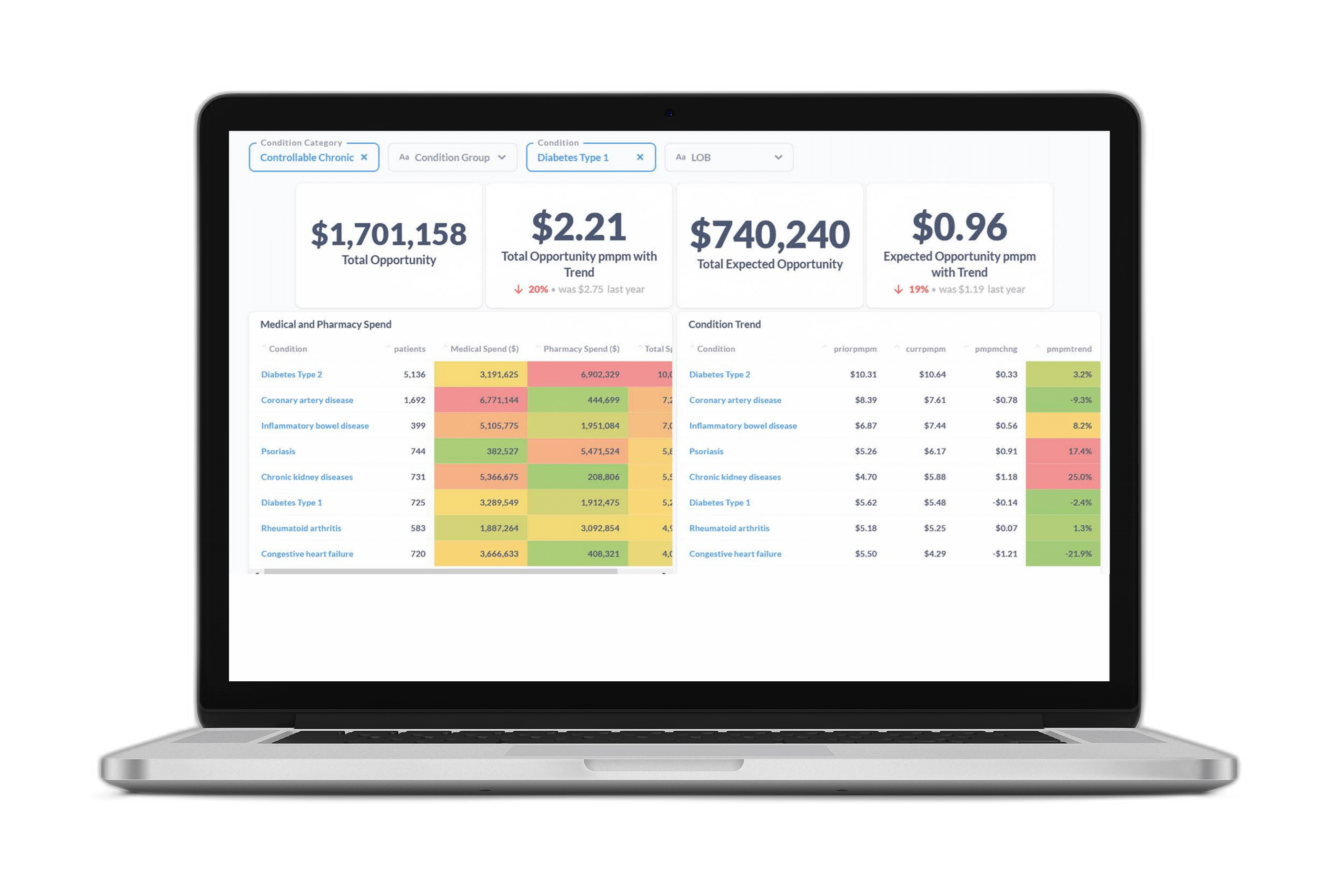

Innovative health plans are accomplishing this through AI-powered employer group reporting packages that show customers the clinical and financial savings opportunities that exist within their populations. But it’s not enough to just show total opportunity. What’s important is modifiable opportunity—the risks that can be mitigated or avoided through earlier interventions or more effective outreach.

For instance, an ASO customer might be spending more total dollars on care related to heart disease than on diabetes. But if this employer’s diabetic members have more modifiable opportunity than those with heart disease, it could make sense to invest medical management dollars on a new diabetes program.

Learn more about how to differentiate yourself in an increasingly value-focused ecosystem. Check out this white paper.

2. Effective strategies require a comprehensive view of member and population health

You generate mountains of data. But is it all connected, cleansed, standardized, validated, and delivered to end users in a way that’s easy to understand and make actionable?

An effective strategy for managing whole-person health must be based on a complete picture of each member’s clinical risk—integrating data from all medical management programs and point solutions and by also unifying both medical and pharmacy claims.

One reason you need a complete picture of member health is that effective medical management often results in better medication adherence. This may lead to increased pharmacy spending, but because the patient is more compliant it lowers healthcare spending overall.

This big picture view of a member or population is only possible if you’ve unified and connected all data sources across all your benefits and programs.

3. Forward-looking health plans are increasingly relying on AI to optimize their outreach initiatives

How can you be sure your medical management programs are reaching the right members at the right time?

Increasingly, health plans are implementing AI-powered strategies to ensure they’re directing limited outreach resources toward the members who will benefit most.

This requires more than just stratifying members based on past utilization trends. It means looking at prospective, modifiable risk—the behaviors and outcomes that can be changed. It also means predicting each member’s likelihood of engaging with outreach programs. By identifying modifiable future outcomes, you can intervene with members earlier to prevent high cost events rather than reacting to costs that have already been incurred.

4. Provider insights are accelerating the shift to value

Innovative health plans are no longer just managing member health—they’re also seeking to incentivize providers to shift from a “fee for service” mindset to a whole person, value-focused mindset.

But evaluating providers can be difficult, since there are so many factors at play. In recent years, though, advanced machine learning techniques have made it possible to identify confounding variables and normalize provider data to compare primary and specialty physicians on an apples-to-apples basis across cost and quality metrics.

Employer customers want to see that you’re steering members to the best points of care and working to build high-performing networks that deliver better outcomes at lower cost.

5. Value-based payment models are increasing the need for program evaluation tools

Risk-based payment models require a sound, transparent approach for measuring success so that all stakeholders can share in savings.

This is becoming more and more important to employer ASO customers that want their health plan partners to have skin in the game.

One way to accomplish this is through retrospective program measurement—quantifying the clinical and financial value of your medical management programs and tools.

AI-powered program measurement is enabling health plans to build compelling ROI stories demonstrating the value of their medical management programs on health outcomes and the total cost of care.

The result? Happier customers, lower costs, and better health outcomes.

Download case study: “National Insurer Saves Millions Through AI-Powered Clinical Outreach.”

Contact us to learn more about how we can help you improve your ASO value proposition and accelerate the shift to value.