Transparency was the goal of the government’s 2021 requirement for healthcare carriers to publicly supply the costs of their services and procedures. But many health plan teams who’ve accessed this pricing data quickly feel overwhelmed when trying to make sense of these enormous and tangled machine-readable files.

It’s why many health plans have turned to trusted data partners like Certilytics to get the actionable insights they need – from rate comparisons to provider reimbursement analysis. Through our experience working with these health plan partners, we’ve put together a recipe health plans should use to transform these dense files into actionable competitive intelligence.

Step One: Wrangle the Price Transparency Data Files

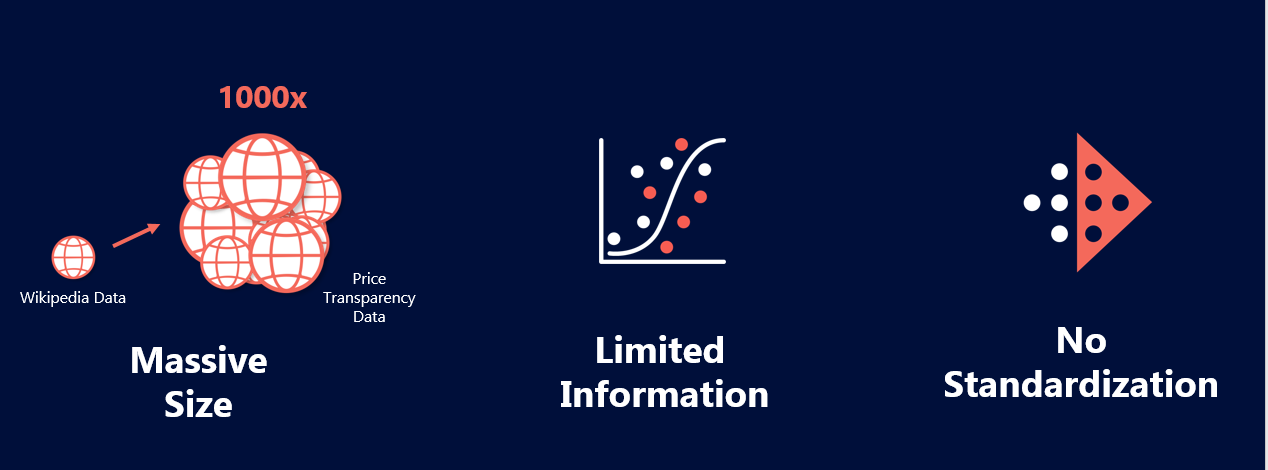

The massive size of the machine-readable files are the first hurdle health plans must face with price transparency data.

While hospital files tend to be easier to digest and consume, they are sparse. Payer data, on the other hand, takes up a larger portion of the price transparency files and they come with much greater complexity due to the amount of contracting payers are involved in.

Put together, the files are enormous, with rates in the trillions. For example, the number of rates presented in these files are 1000x larger than the total number of pages on Wikipedia.

Simply ingesting the pricing information necessary to gain competitive insights is a major lift for health plans, and requires a data analytics platform capable of consuming terabytes of data.

Health plans should identify a trusted data and analytics partners who has the capacity to aggregate massive volumes of data. The partner will eliminate this obstacle by not only wrangling the data together, but cleansing it to get actionable insights.

Step Two: Normalize and Enrich the Data

In addition to the massive size of the data, inaccuracies, incomplete information, and incongruities within the files make simply collecting price transparency data insufficient.

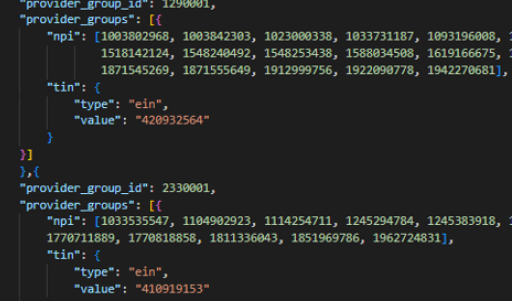

Why? Even with the data aggregated, health plan partners struggle to easily compare rates because providers are buried beneath an inconsistent tangle of misaligned labels, naming conventions, and different organizational structures across carriers.

For example, information on one plan could be spread across multiple files, or one file could contain multiple rates. Multiple providers could be associated with one national plan that has filed their information nationally, making a rate comparison in a local market time consuming.

On top of that, fees must be verified for accuracy before any rate comparison occurs because carriers are supplying information about their prices themselves.

In order to have a complete picture of the data, a health plan should enlist a data partner to validate the prices, and fill in these gaps. First, a data partner can normalize all the files into a consistent data layer and categorize them. This processing of standardizing the price transparency language is the first step a health plan needs to take in order to understand its competitive landscape.

Once all the files are consistent, linking the MRF files to supplemental provider data will unify providers across data sets. This begins to bring the competitor picture into focus because it links group practices and health systems together, helping isolate and fill any gaps as well as verify that carriers have supplied accurate information about their files. For example, Certilytics’ extensive provider database of approximately 7 million providers helped pinpoint a price discrepancy from one provider.

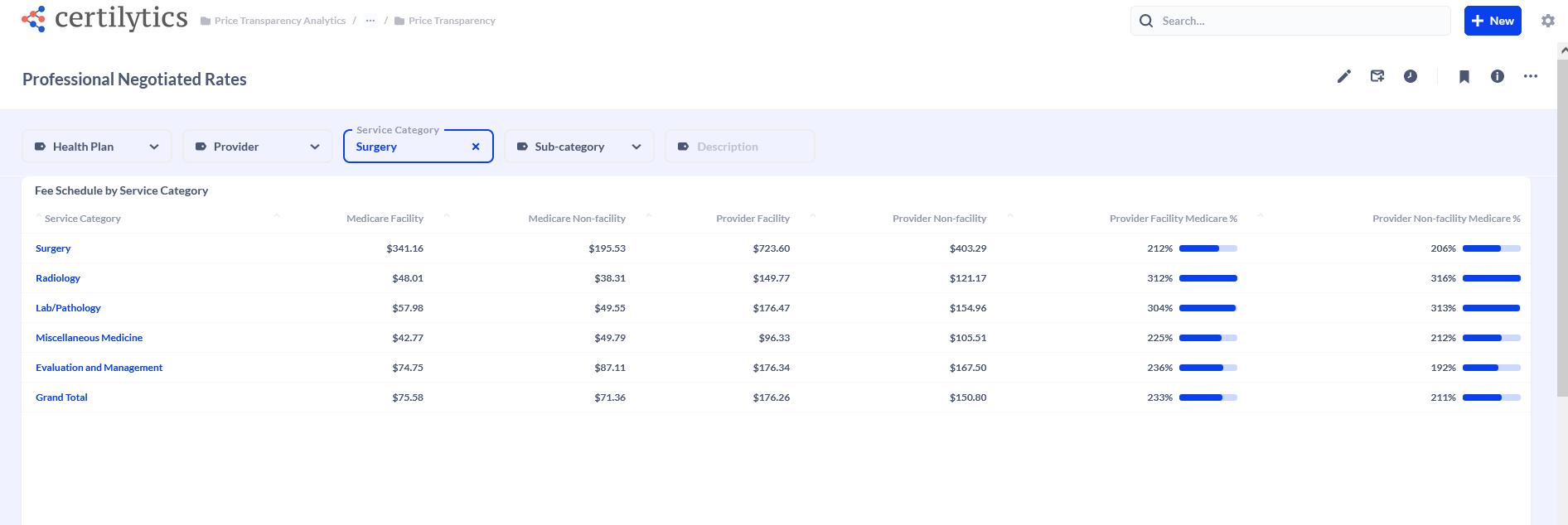

Professional Rates

Professional Rates

An efficient data partner will also link the price transparency data with supplemental provider datasets including COB data. This not only further verifies prices and fills in some holes, but allows for a robust rate and utilization comparison across competitors.

Step Three: Generate Reports and Analysis to Gain a Competitive Edge

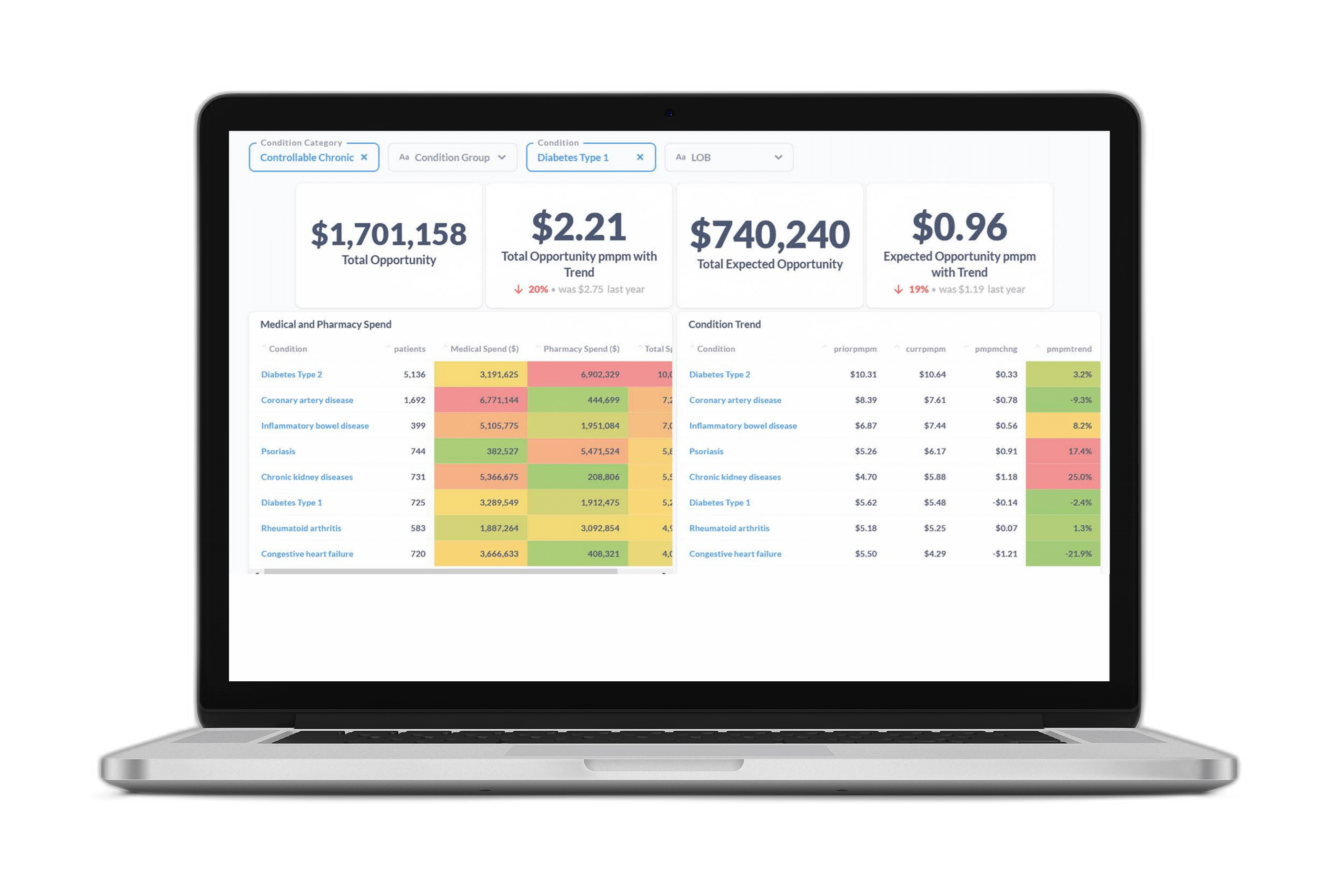

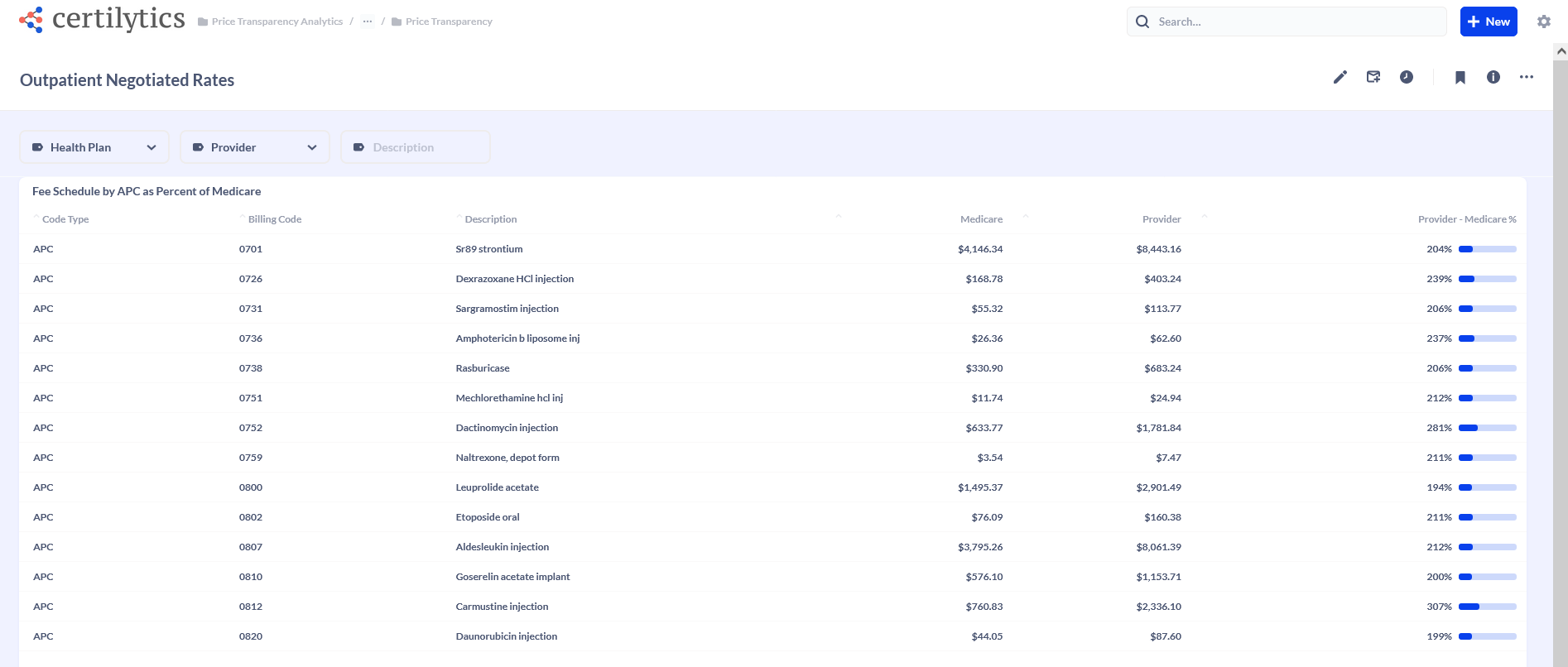

Once the data is cleansed and ready for analysis, a data partner can also save a health plan time and resources by supplying insights through intuitive reports and dashboards.

With access to a powerful and flexible data platform, health plan teams can find answers and explore the massive data efficiently and quickly through comprehensive, curated views of competitor fee schedules and provider reimbursement fees.

For example, Certilytics supplied our health plan customers with both a summary competitor network fee schedules across inpatient, outpatient, and professional service categories as well as access to the source MRF datasets.

The Certilytics’ reports include the client’s reimbursement benchmarked against Medicare fees where possible.

Outpatient Rates

With these insights, health plans can gain clear, unprecedented visibility into where they stand in a highly competitive market. Then, they can use that intelligence to support provider contracting efforts, improve the overall value of their plan, and accelerate customer growth and retention.

How can a health plan use price transparency data and insights to advance their goals? Check out our next blog to see three ways health plans have turned competitive intelligence into a competitive advantage.