When price transparency legislation went into effect in January 2021, the goal was to empower patients to make informed healthcare decisions. With cost information about healthcare procedures and services at their fingertips, consumers could compare prices across different providers and make the most cost-effective decision for themselves.

But this rapid introduction of historically unavailable pricing information also gave health plans an advantage. By accessing this publically-available data, health plan leaders gain the ability to see where they stand in a highly competitive market. That kind of intelligence has wide-ranging impacts from negotiating better provider contracts to advancing top priorities like offering affordable and accessible care.

The catch? The enormous machine readable files in which this data is delivered is anything but transparent.

Working with our health plan customers, we’ve seen firsthand the challenges that come with this influx of complex, new data but also the opportunities that arise once health plans leverage data analytics to transform these files into actionable intelligence.

Keep reading to learn the three biggest challenges and opportunities of price transparency data for health plans.

Challenges with Price Transparency Data

1. Information Accuracy

Carriers are responsible for providing their pricing information, but who’s checking to make sure it is accurate? Verifying the accuracy of pricing data for just one carrier can be like finding a needle-in-a-haystack, not to mention multiplying this task hundreds and hundreds of times.

A comparative analysis of a given price requires enriching the price transparency data with supplemental provider data and COB data if available. Once providers are unified across datasets, it is possible to link group practices and health systems and validate provider fees.

This task is a necessary step to build an accurate, data-backed picture of a health plan’s competitive landscape, but it’s also resource-intensive. It’s why many health plans are turning to a trusted data management and analytics partner to give them confidence that they are working with the best possible figures.

2. Complex Data

Even if health plan teams know they are working with accurate numbers, they still face a trifecta of data hurdles with these machine-readable files.

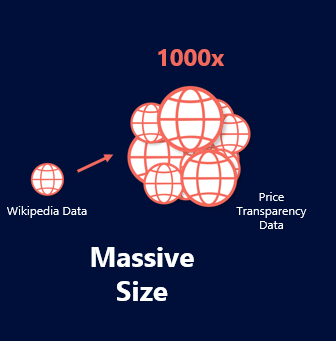

First, there’s simply the files’ massive size. Because of the complex contracting that payers are involved in, payer data is much more complex and bigger than hospital systems. To put it in perspective, the number of rates presented in these files are 1000x larger than the total number of pages on Wikipedia.

Second, there’s no standardization, requiring health plans to aggregate and normalize all of these massive files into a consistent dataset. For example, information on one plan could be spread across multiple files or one file could contain multiple rate

In addition, generic naming conventions create difficulty in understanding which product and network relates to which file.

In order to even begin analysis, health plans would need to standardize each competitor’s data. Then they would have to categorize that data and enrich it with other available provider data.

Handling the size and translating this kind of data requires data processing and analytics expertise, along with technology that is often beyond a health plan’s resources.

3. Incomplete Information

We’ve already talked about how carriers could provide inaccurate information, but there’s also potential for them to leave gaps.

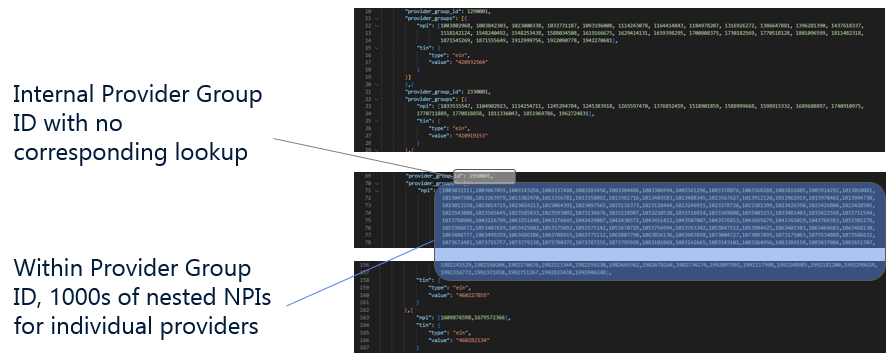

Health plan teams could discover incomplete information in the price transparency files. In the example below, the internal provider group ID came with no corresponding lookup information and nests of thousands of NPI’s. We are therefore presented with very little information about this provider group along with every rate for the provider group ID mapped to all of these providers, regardless of the fact that many of the individual providers do not fulfill the type of service in question.

Filling in these gaps again requires standardizing, normalizing, and linking the price transparency data with other provider data. From this, health plan teams can work from a complete picture of competitor fees across inpatient, outpatient, and professional service categories.

Opportunities with Price Transparency Data

Despite its obstacles, the machine-readable files present health plans with unprecedented visibility into a highly competitive market. Making sense of these figures affords health plans three competitive advantages:

1. Access to Benchmarks and Reporting Data Not Currently Being Utilized by Competitors

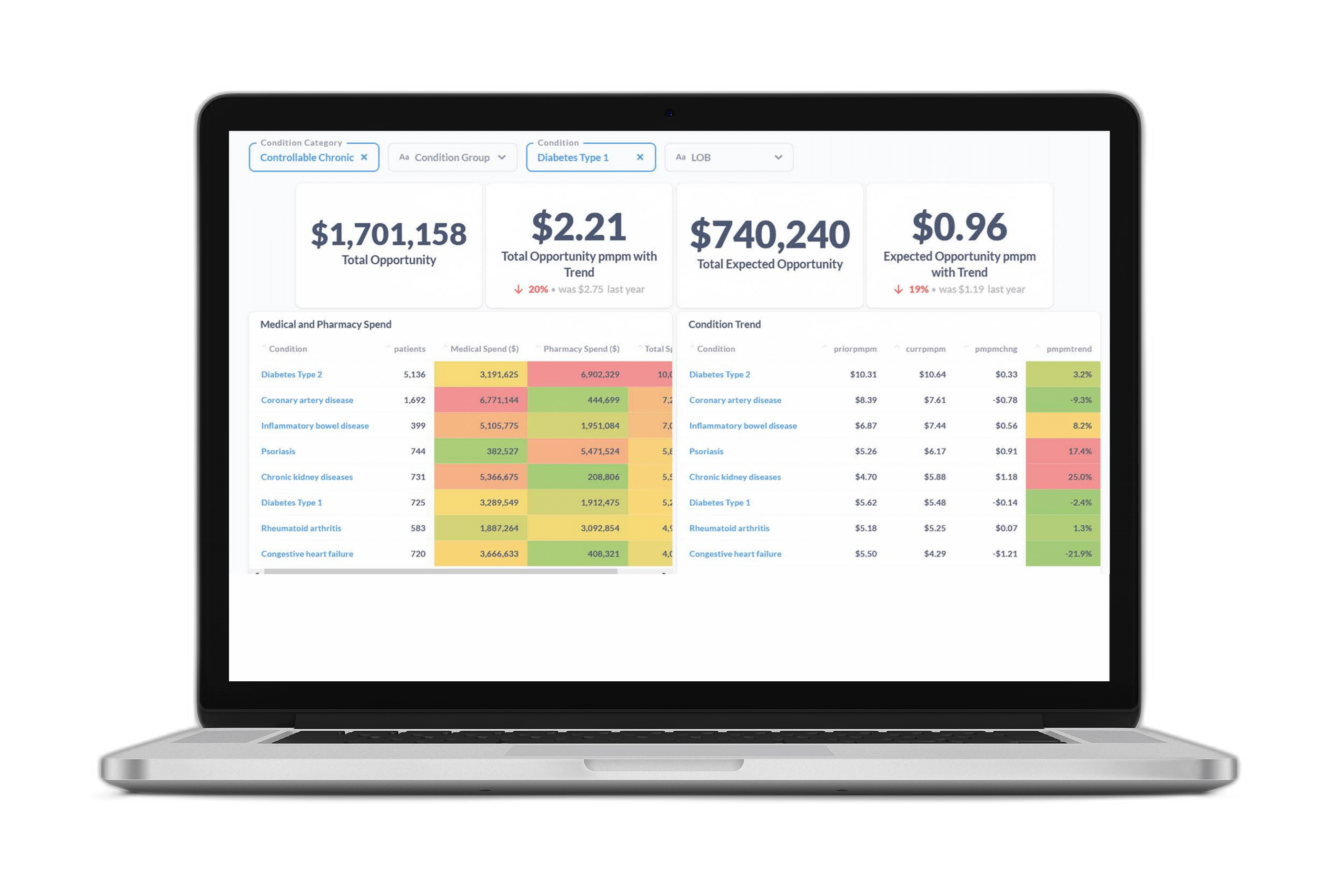

Detangling the data gives health plan analytic teams the ability to compare their plan’s pricing, networks, and rate file completeness with other plans.

Imagine drilling down into price variance across different services, price bundles, and locations. With this intelligence, health plan teams gain insight into where their offerings are competitive, plus where adjustments may need to be made.

2. Strengthened Negotiating Power in Provider Contracting Efforts

When it comes to providers, the price transparency data allows health plan analytics teams to see the prices providers are offering competitors, specifically which providers are offering competitors lower prices.

This kind of insight gives health plans the upper hand when it comes to securing a desired contract.

3. Develop Strategies to Win and Retain Business with Employer Clients

Price transparency insights can also give health plans an advantage in acquiring and retaining employer clients. Price comparison allows health plans to understand which of their employer clients may be at risk based on pricing, and adjust offerings to retain that business. They also gain visibility into new employers who would be better served by their health plan offerings.

From this insight, a health plan can build business strategies to better retain and attain new business.

Do you want to learn more about using price transparency data to gain a competitive edge? Check out Certilytics’ approach that is helping leading health plans succeed.